BTCUSD course forecast from June 27 to July 3

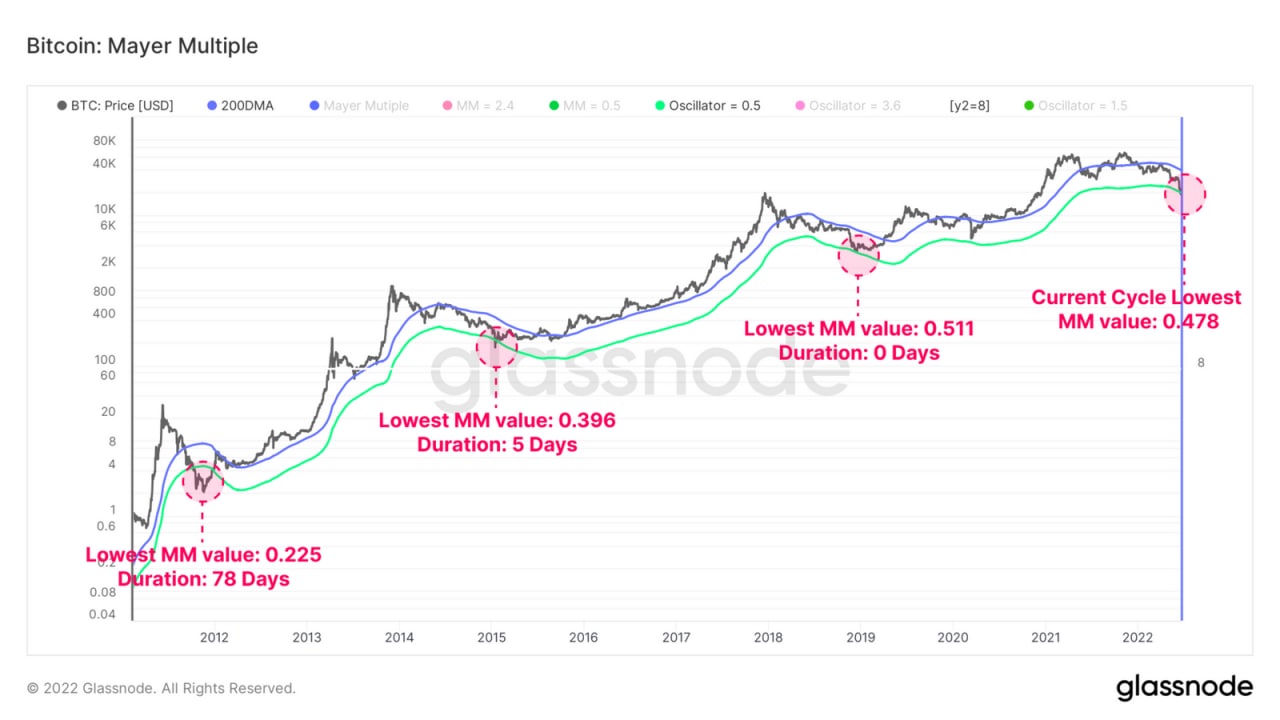

BTC survived one of the most powerful deviations below the 200-day trend in history. Currently, the Mayer coefficient is 0.478, that is, the price of BTC is 52.2% in relation to the 200-day sliding medium.

To illustrate how rare such an event is, we note that in the history of BTC prices were closed with the Mayer coefficient of 0.5 or lower only 3% of all trade days. However, judging by the previous cycles of the bear market, this coefficient still has opportunities to reduce: in the 2012 cycle, its minimum value was 0.225.

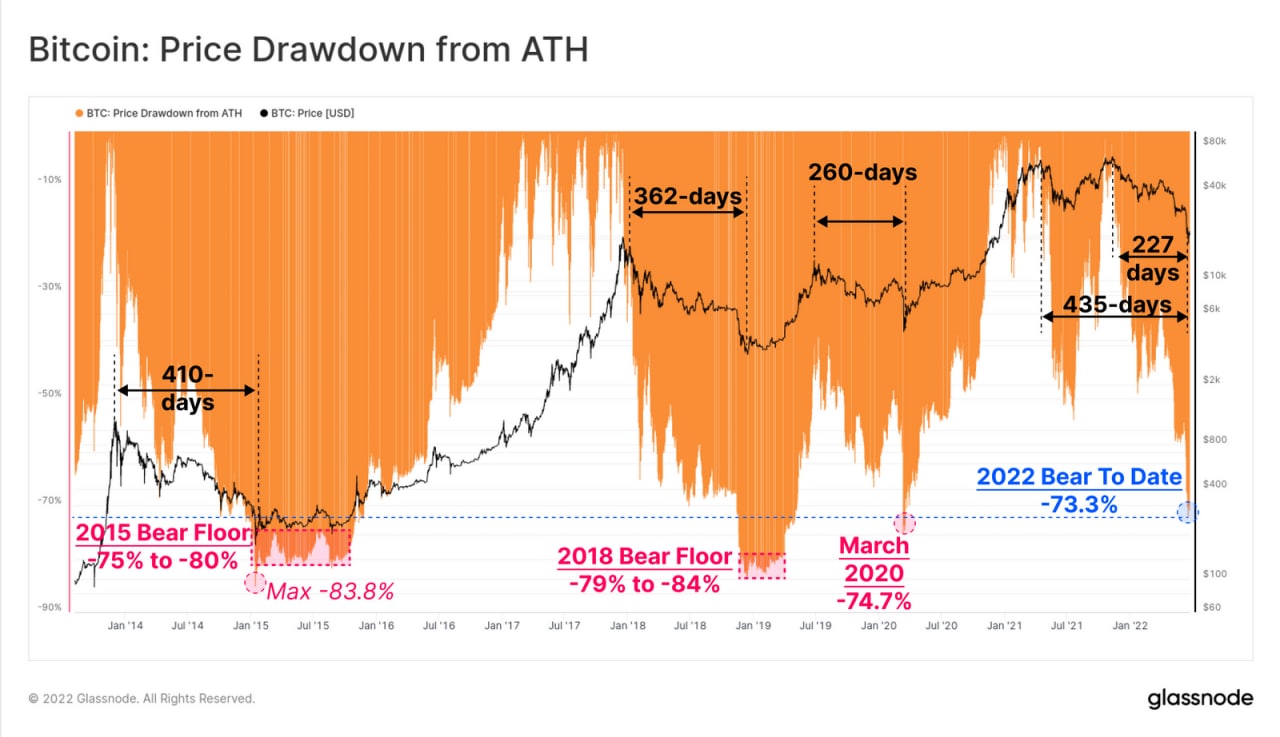

Similarly, the use of previous Bear Market cycles as a standard shows that although the BTC is located near the cyclic bottom, we are not quite there, since the current subsidence of the cycle is 73.3%.

Previous cycles reached the bottom between subsidence from 74% to 84%.

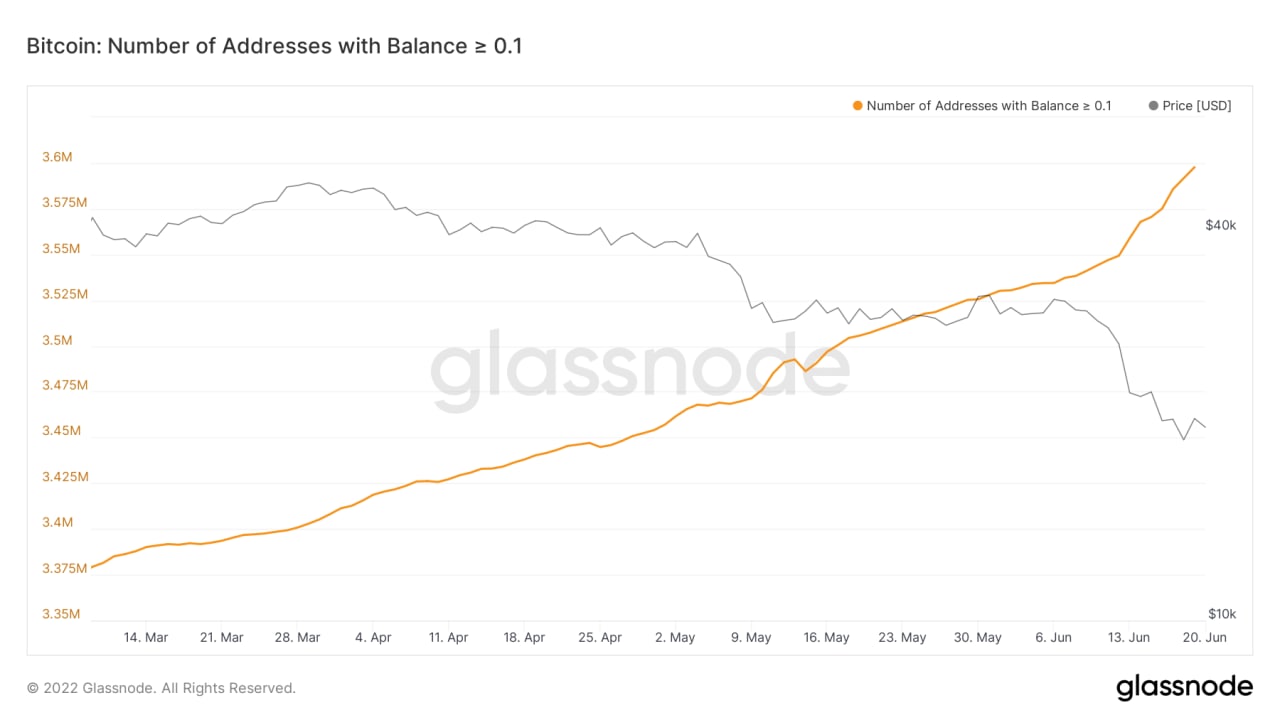

Over the past two weeks, the number of addresses on which at least 1 BTC has been stored has grown by more than 15,000.

The number of small holders also has grown phenomenally, which is a sign that retail players decide on the accumulation. Over the past seven days, BTC has many small holders, since the addresses of small wallets containing 0.1 or more BTCs continue to accumulate BTC with a rapidly growing speed.

Since June 13, the number of addresses containing at least 0.1 BTC also increased by about 100,000.

However, on the contrary, the number of wallets containing more than 100 BTCs decreased by 136 during the same period. This means that medium whales can unload their wallets in favor of new smaller holders, which is a good sign for decentralizing the influence on BTC in the long run.

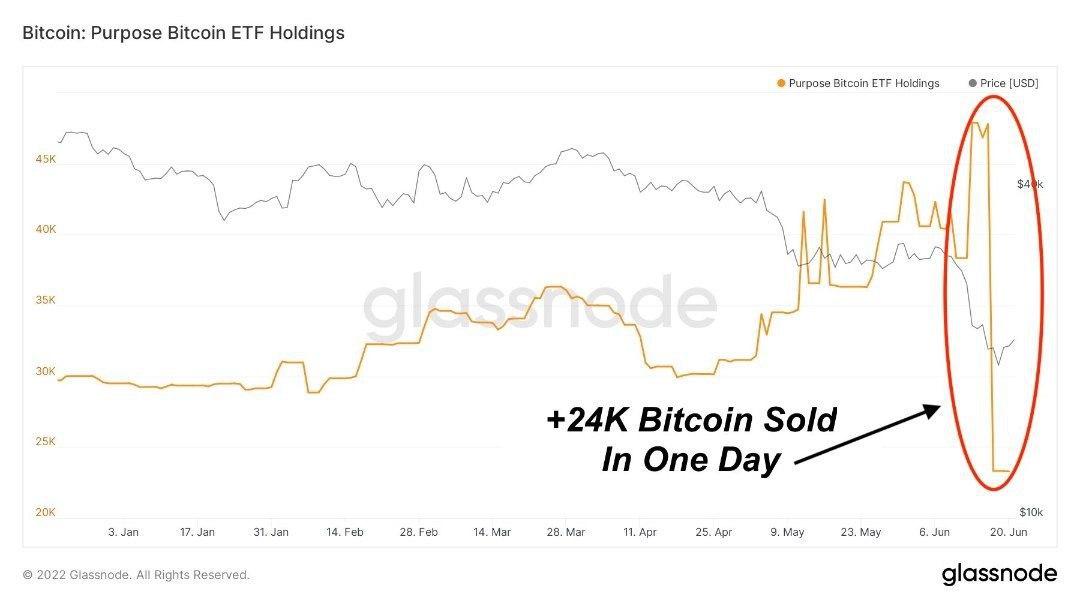

The Canadian target BTC ETF sold more than 24,000 BTC last Monday, about half of its assets, just a day after its assets reached ATH.

Without a direct influence on the price of BTC, this sudden repayment may be related https://gagarin.news/news/ledgers-ceo-fears-that-a-new-european-law-would-encroach-privacy/ to fears about regulation, since the Ontario securities commission last week imposed significant fines and a ban on a couple of cryptocurrency exchanges.

In addition, the emergence of the new Short BTC Strategy Fund fund may also contribute to the fact that some ETF players switched from long positions for short.

Proshares, managing the Short BTC Fund, announced that the first of its kind of the BTC short strategies Fund (BITI) on the second day of trading on the New York Stock Exchange sold more than 870,000 shares, or 35 million US dollars.

Most experts do not believe that the presence of this Short BTC ETF fund may affect the price of BTC, since the industries already have tools that are easily accessible to traders to occupy short positions on exchanges.

This material is not a financial advice and brings only familiarization information.

Revenuebot has a Telegram chat for users and an official Telegram channel where the service news is published, as well as relevant information from the crypto industry. You can familiarize yourself with the capabilities of the service on the official website Revenuebot .